Alaska’s Railbelt Gas Crisis

Alaska’s Railbelt electrical grid-which serves about 75% of the state’s population-is facing an imminent energy challenge due to declining natural gas reserves in Cook Inlet. This natural gas powers about 70% of Railbelt electricity generation, and it is also used to heat a large fraction of the state’s population and businesses. The shortfall is expected to begin starting around 2027-though some related impacts have already started to appear.

This situation-commonly known as ‘the Railbelt gas shortage’, or simply ‘the gas crisis’-has utilities pursuing natural gas imports to ensure energy security, which will require building import terminals and expanded storage capacity to meet peak and seasonal demand. Given the time remaining before gas shortages begin-and a lack of alternatives that can meet the timeline-this seems like the prudent path forward in the immediate future.

It’s also important to recognize that the rising energy prices associated with importing gas will affect energy prices in rural Alaska too. This is because the state’s Power Cost Equalization program uses Railbelt rates as a target for rates in rural Alaska.

As part of an effort to identify long-term solutions to the situation, the ACEP Railbelt Decarbonization Study and the NREL 80% Renewable Portfolio Standard reports offer valuable insights into how Alaska could stabilize energy costs, develop local resources, reduce reliance on high-cost imported gas, and reduce carbon-dioxide emissions.

These two studies evaluate a range of scenarios for decarbonizing the state’s Railbelt electrical grid, and evaluate the cost implications of doing so. I’ve written previously about the NREL study, where I highlight their result that investing in wind and solar projects would minimize Railbelt energy costs. The ACEP study is somewhat less optimistic: it finds clean energy costs are between 5% less expensive and 30% more expensive than relying primarily on gas imports.

This is where I suspect many readers of these two studies get a little lost: which is it? Are clean energy technologies more or less expensive than the status-quo, or not? What should Alaska do now?

The truth is that these reports have very similar results with regard to near-term clean energy solutions for the Railbelt. Let’s take a closer look…

The Gritty Details

Both of these studies employ capacity expansion approaches to identify future grid scenarios that could meet future Railbelt energy needs. NREL’s work employs an optimization algorithm to identify the lowest-cost scenario throughout the study period (up to 2040). Because the approach emphasizes lowest-cost, the results emphasize the lowest-cost commercially-available renewable energy technologies: primarily wind and solar. It is an efficient and rigorous approach that has been used in other large-scale studies around the country (e.g., Puerto Rico, and Los Angeles).

ACEP’s study uses a manual iterative approach to identify capacity needs for the year 2050, and looks at a wider range of technologies that have higher costs than wind and solar. The ACEP study also includes an analysis of grid stability to make sure that the scenarios they evaluate can not only meet the demand requirements (kWh of energy), but also maintain stable operating conditions (voltage and frequency) during major disturbances to the system-such as transmission line faults and unexpected generator station outages. The added cost of components and infrastructure necessary to maintain grid stability are added to their scenario costs.

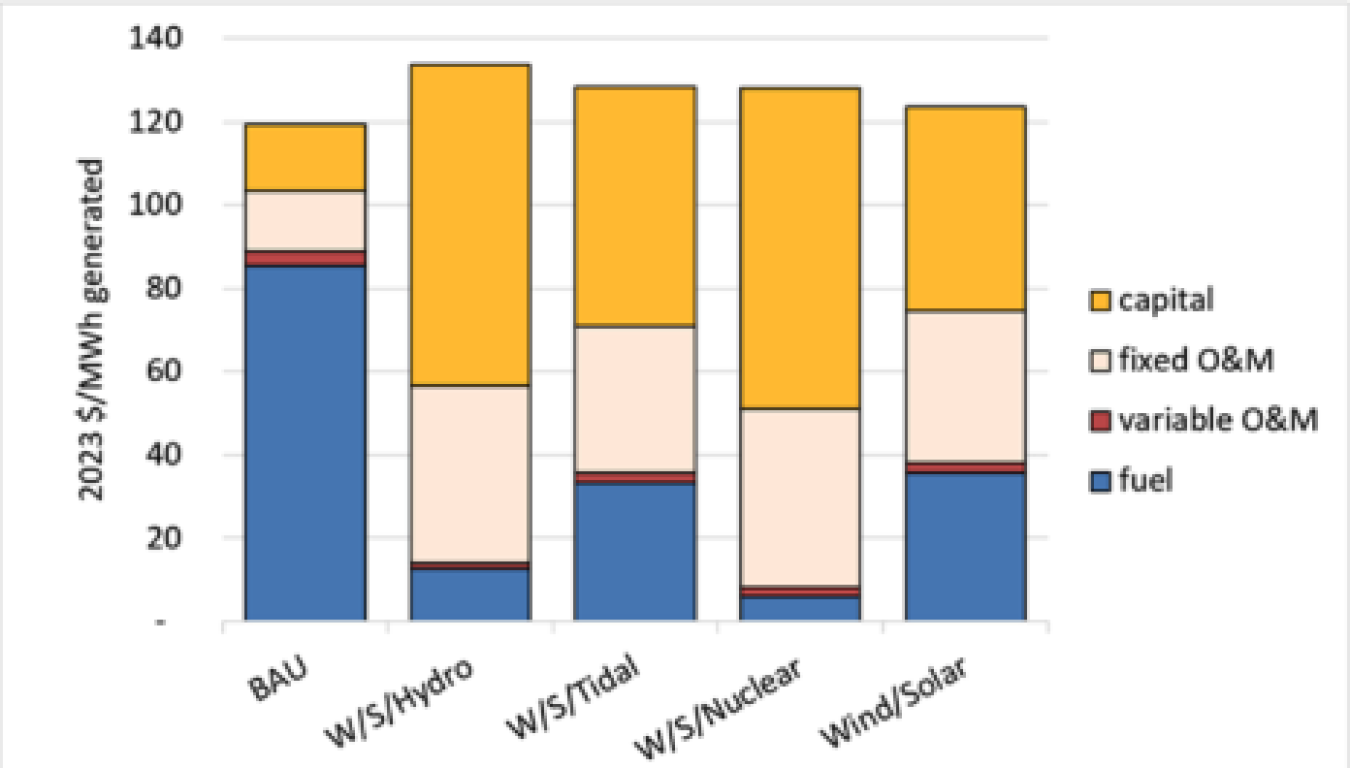

The ACEP study compares the energy costs of four scenarios to a ‘business as usual’ (BAU) case that relies primarily on natural gas imports (Figure 1):

- A wind, solar, and hydroelectric (“W/S/Hydro”) case that includes building the 500MW to 600MW Susitna-Watana hydroelectric project.

- A wind, solar, and tidal case that includes 400 MW of tidal energy capacity in Cook Inlet.

- A wind, solar, and nuclear case that includes building about 500 MW of nuclear capacity on the railbelt.

- A wind and solar only scenario, where the size of the wind and solar are determined

What I find most striking about these results is that the cost of energy in all of the scenarios-which involve major differences in generation infrastructure and system operations-are all within 12% of the business-as-usual case. Also note that the size of the fuel cost bars (blue) in this figure provide an approximate indication of relative carbon emissions for each scenario. It is also important to recognize that none of these scenarios eliminates the need to import natural gas in the short-term because: 1) they cannot be built quickly enough to fill the gap in gas supply, and 2) they do not include replacing the heat currently provided by gas.

In the business as usual case (Figure 1, “BAU,” far left), energy costs are dominated (~70%) by fuel costs. The wind, solar, and hydro (“W/S/Hydro”) scenario reduces carbon emissions by nearly 90%, but it is also projected to be the highest-cost scenario. However, we should be careful not to interpret the scenarios that include tidal and nuclear as actually being lower-cost because-as the authors are careful to point out-these scenarios use cost targets, rather than real-world cost data. This is because these technologies are in pre-commercial demonstration phases, and actual costs are poorly defined. Therefore, the uncertainty in the costs of these scenarios is much larger than the others. Furthermore, because these technologies are pre-commercial, the timeline for deploying them at this scale has much more uncertainty than the other scenarios.

This leaves the ‘wind and solar only’ scenario, which was investigated as part of an addendum to the original report. While the carbon emission reductions are not as large as the hydro and nuclear scenarios, this scenario does reduce carbon emissions by more than 60%. When this is combined with existing renewable energy sources, the total fraction of electricity generation from carbon emissions free sources is 77%. Notably, this is the same clean-energy fraction that NREL identifies in their least-cost scenario that also relies primarily on new wind and solar installations.

ACEP’s study estimates that the cost of this scenario is between 4% less expensive and 6% more expensive than the business as usual case, and they attribute this uncertainty to macro-economic factors such as fuel costs, interest rates, and renewable capital costs. For example, if imported natural gas is 20% more expensive than they estimate, then the wind and solar case saves 4%. On the other hand, if renewables are 20% more expensive than they project, or if interest rates are higher, then the wind and solar case is 6% more expensive than business as usual.

A Wider Viewpoint

When considering these details in the context of NREL’s analysis, it’s easy to focus on questions like: “Why don’t the results agree?” “Which one is right about costs?” and, “Are clean energy technologies more or less expensive than the status-quo?” These questions miss the point that these two reports actually have very consistent results. They both tell us that wind and solar technologies are the most cost-effective clean energy solutions for the foreseeable future, and that these costs are competitive with conventional energy sources (gas imports) for Alaska’s Railbelt. They also agree that the lowest-cost scenario is one in which about 75-80% of Railbelt electricity comes from wind and solar. It is also unsurprising that the ACEP report’s costs are slightly higher, because that work explicitly accounts for the infrastructure costs necessary for maintaining grid stability.

Whether these solutions are actually 5% more or less expensive than the business as usual case depends on macro-economic factors such as interest rates, clean-energy technology cost projections, and-since the Railbelt’s local source of natural gas is dwindling-global gas prices. It should also be noted that while the cost of clean energy technologies has recently seen an uptick due to inflation and other supply-chain factors, the long-term trend has seen declining costs.

This situation raises several important questions for Railbelt utilities, regulators, and customers:

- To what extent do Alaskans make investment decisions for the Railbelt’s energy sources based solely on cost estimates? Which cost estimates are most accurate?

- If the uncertainty in costs is larger than the difference between two options (e.g., business-as-usual vs. wind and solar), then to what degree can these decisions also consider other factors such as:

- Local economic growth associated with local energy projects;

- Energy security associated with local energy supply vs. energy imports;

- Reducing carbon emissions; and

- Building a workforce knowledgeable in operating and maintaining new clean energy technologies

How much natural gas Alaska imports-and how much storage capacity is required-will ultimately depend on things like how much energy demand changes, how long gas production in Cook Inlet continues, whether a gas pipeline from the North Slope is built, how quickly local energy projects are built, and how quickly Alaskans install alternate heating sources-such as high-efficiency low-temperature heat pumps. In the meantime, caution in committing to long-term gas contracts will allow for flexibility to transition toward local energy sources more quickly.

By investing in local energy projects now, the Railbelt can accomplish several major objectives at once: stabilize energy prices, improve energy security, and foster local economic growth. The use of clean energy sources as described by the ACEP and NREL reports also has the added benefits of reducing carbon emissions and building a workforce that is knowledgeable in operating and maintaining clean energy infrastructure-which is a rapidly growing portion of the global energy economy. How fortunate is it that this is also an economical path?

Keep up to date on this and other U.S. Arctic issues by subscribing to the Arctic Energy Office Newsletter.